A global network of scholars, advocates, and financial organizations working to understand and empower the linkages between lending and human values.

Why Dignity?

Loans enable people to realize their visions of a good life, yet many families across the globe are falling into life-altering debt. Worried that they will forever be enslaved by it, some parents have trouble sleeping and their health and relationships diminish. Debt affects their ability to help loved ones live with dignity, whether they be children or aging parents with inadequate resources. Further, debt can reduce self-esteem, motivation, and capacity to participate effectively in civic life and financial institutions. Financial propositions that lack a vision of dignity treat people like robotic quantities, occluding the very moral values that give financial sacrifices meaning.

Latest Updates

IN THE NEWS

PEW features new Debt Collection Lab

PEW features new Debt Collection Lab

The Pew Foundation interviews Fred Wherry on the Lab’s debt collection lawsuit tracker.

NY Times Publishes Essay by Network Members

NY Times Publishes Essay by Network Members

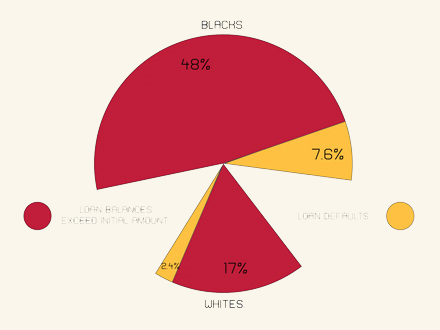

Eaton, Villalobos, and Wherry argue for debt relief because of poor lending practices.

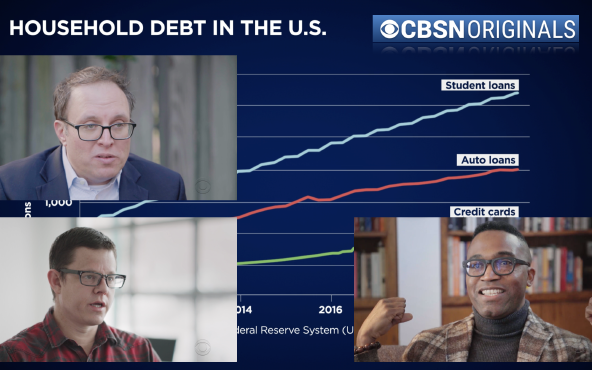

Network members talk to CBS News about Student Loan Debt Forgiveness

Network members talk to CBS News about Student Loan Debt Forgiveness

The half-hour documentary features Fred Wherry, Charlie Eaton and Seth Frotman.