PEW features new Debt Collection Lab

The Pew Foundation interviews Fred Wherry on the Lab’s debt collection lawsuit tracker.

NY Times Publishes Essay by Network Members

Eaton, Villalobos, and Wherry argue for debt relief because of poor lending practices.

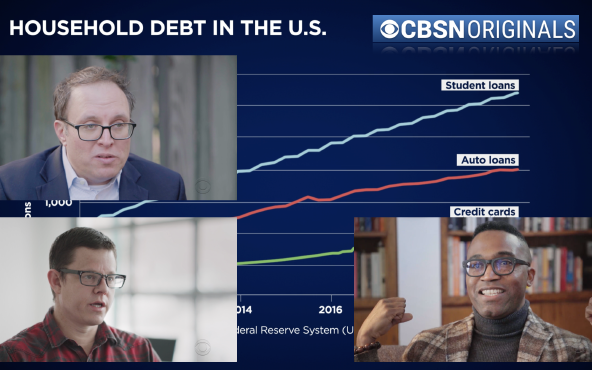

Network members talk to CBS News about Student Loan Debt Forgiveness

The half-hour documentary features Fred Wherry, Charlie Eaton and Seth Frotman.

Dignity+Debt Network in CBS Report on Student Loan Debt

CBS News features, Charlie Eaton, Seth Frotman, and Fred Wherry in a half-hour documentary on student debt forgiveness.

Wherry in conversation with Clint Black at National Book Festival

Fred Wherry moderates a conversation with Clint Black, author of How the Word is Passed at the Library of Congress National Book Festival

CNBC talks racial credit scores with Fred Wherry

Wherry is interviewed for a CNBC story on the role of structures of racism in lowering credit scores.

Wherry speaks at New York Fed Event

Fred Wherry speaks alongside other authors of The Future of Building Wealth.

Intrinsic Racial Inequities in Credit Rating

Read Fred Wherry’s column in the Boston Globe on how credit scores were founded on, and perpetuate, racial inequality.

NPR Marketplace talks with Wherry on fixing credit scoring

Fred Wherry is a featured guest on the Marketplace podcast “Make Me Smart.”

badcredit features Dignity + Debt Network

Fred Wherry spoke with Matt Walker from badcredit.org about the mission of the Dignity + Debt Network and the strength of having many partners at Princeton and beyond.