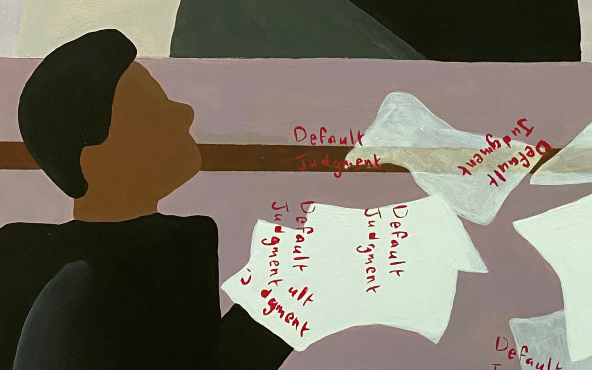

The Debt Collection Lab

The Debt Collection Lab visualizes the increasingly uneven distribution of debt collection lawsuits in the US by neighborhood and race. People who already had trouble paying their bills saw those troubles multiply during the Covid-19 pandemic. Although there were some moratoriums on debt collection, thousands of lawsuits were still being filed in a single county court per month.

The Du Boisian Visualization Toolkit

An expanding project with design specifications and coding tools to help designers, artists, developers, writers, and scholars who want to visualize their data in the “Dubois Style” of graphs created by sociologist W. E. B Dubois' and his team for the 1900 Paris exposition.

The Student Debt Initiative

The Dignity + Debt Network is working on a number of related project intended to reveal the structures and and meanings of student loans and to find solutions to the debt traps. Whether you are a student with a loan or a scholar, or both, we invite you to engage and even contribute to our work.

Visualizing Dignity and Debt

How can debt traps be made visually clear while not also rendering those who succumb to those traps as unthinking dupes? And how can the visualization of debt traps and of the indignities of debt collection differentially be used to understand and to change those processes? The Dignity and Debt Network visualization initiative will develop a new set of public goods, visualizations of dignity, respect, and autonomy alongside data on debt, debt traps, and meaningful financial inclusion across the globe.

Understanding What's Fair

This project asks what are the folk understandings of fairness when using financial services and, in particular, when dealing with consumer financial service providers and debt collectors. What metaphors and images are used to relay the experience of fairness or unfairness, of respect or disrespect? Using computational techniques to analyze thousands of textual complaints from the Consumer Financial Protection Bureau (USA), the Public Defender Office of Over-Indebtedness (Brazil), and a private sector consumer complaints database in Brazil as well as discussions on Twitter and other social media platforms about financial service providers acting unfairly or disrespectfully. In-depth interviews with individuals at complaints bureaus/ desks as well as with consumers will round out the project. Funding for this project has come from the Mastercard Center for Inclusive Growth. Expected competition: April 2019.

Global Labs

Research teams working in about a dozen countries are assembling data on debt and human values, namely dignity, respect, and economic morality. Team members include qualitative researchers, computational social scientists, and quantitative analysts. These teams are developing insights into financial well-being that goes beyond how much people need and how much they owe. We investigate the meaningful qualities of economic life that inform the decisions consumers make about educating and providing for their children, finding a safe place to live, and participating honorably in their communities. And we demonstrate how these values and social relationships can be identified and tested for their effects on consumer financial behaviors. Special attention is given to the narratives consumers tell and those told about them—narratives that motivate, modify, or preclude action.

The Dignity + Debt Network has already launched one demonstration project, “What’s Fair in Finance”, and intends to initiate three more. These projects rely on partnerships with academic and non-academic institutions in the Global South, making the experience of the SSRC in Africa especially important for demonstrating its capacity to coordinate with researchers and practitioners to efficaciously administer research grants.

The Dignity + Debt Network has already launched one demonstration project, “What’s Fair in Finance”, and intends to initiate three more. These projects rely on partnerships with academic and non-academic institutions in the Global South, making the experience of the SSRC in Africa especially important for demonstrating its capacity to coordinate with researchers and practitioners to efficaciously administer research grants.

Getting Respect

Collecting between 240 and 300 interviews in four to six countries as well as direct observations of consumers, this project asks individuals when they have experienced (or believed they would experience) disrespect or respect while trying to access formal financial services. The project also asks how they evade, manage, or transform these experiences as well as what these strategies look like and how they are remembered (visualized). The country teams available to participate are in Brazil, Argentina, Kenya, South Africa, India, and Russia. (Anticipated dates: February 2019 to May 2021)

Designing For Dignity

Collaborating with the Keller Center at Princeton, this project would innovate on the Tiger Challenge model to assemble undergraduate and graduate students alongside practitioners and beneficiaries to modify existing financial products and to build new ones. The project would include measures of dignity and respect to assess whether dignity has a payoff for service providers (repayment likelihoods) and for consumers (attitudes towards financial services, their willingness to pursue full financial inclusion, and their financial well-being). The project would also develop a small team of research fellows for ongoing computational analyses. (September 2018 to May 2020.)